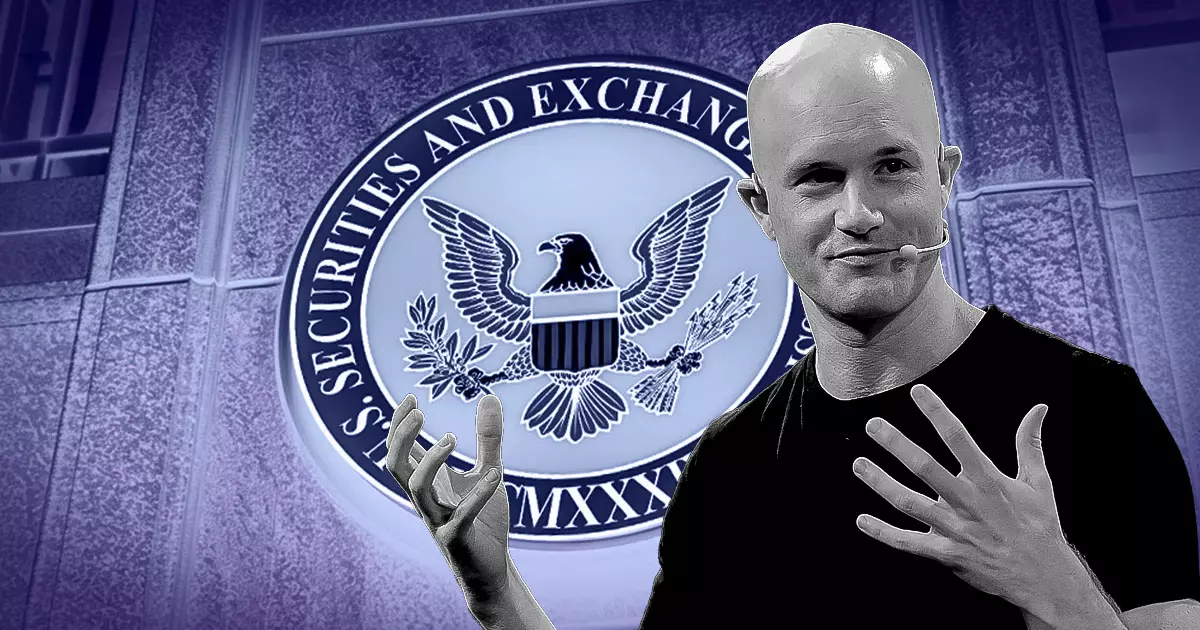

In a recent fervent appeal, Coinbase CEO Brian Armstrong has urged the forthcoming Chair of the U.S. Securities and Exchange Commission (SEC) to acknowledge and dismiss what he deems as “frivolous” legal actions against cryptocurrency firms. Armstrong took to social media platform X on October 29th, arguing that these lawsuits not only stem from a misunderstanding of the crypto landscape but also erode trust in regulatory institutions. He posits that a public apology from the SEC could serve as a crucial step towards mending relations with the industry and the public, despite recognizing that such a gesture wouldn’t rectify past grievances entirely.

Armstrong’s critique highlights a growing perception of inconsistency in the SEC’s regulatory approach under the leadership of Gary Gensler. He points out a marked lack of clarity regarding the status of digital assets, which has yielded confusion among firms attempting to navigate the regulatory terrain. Specifically, Armstrong notes a troubling back-and-forth regarding whether cryptocurrencies fall under the aegis of securities laws. In 2018, the SEC was explicit in its dismissal of digital assets as securities, yet only three years later, it pivoted sharply, asserting that these assets could be categorized as investment contracts. Such fluctuations not only complicate compliance for businesses but also hinder the growth and advocacy for this burgeoning sector.

Further complicating matters, the SEC’s claims around its jurisdiction over cryptocurrency exchanges have been equally inconsistent. Initially, the agency asserted there was no specific regulatory body governing these exchanges in 2021. However, this assertion was soon contested when the SEC proclaimed, just a year later, that it did indeed possess Congressional authority to supervise these platforms. This back-and-forth not only engenders confusion within the industry but raises alarming questions about the SEC’s grasp on the evolving digital asset landscape. The SEC has historically held an ambiguous stance on securities law as it relates to cryptocurrency, oscillating between expressions of uncertainty and claims of regulatory clarity.

The ramifications of these regulatory inconsistencies have led to an uproar within the cryptocurrency community, prompting calls for an overhaul at the SEC. Many stakeholders, both in the industry and political spheres, echo Armstrong’s sentiment concerning the need for a more coherent regulatory framework. Republican presidential candidate Donald Trump has notably pledged to remove SEC Chair Gensler if he assumes office, highlighting the growing frustration among lawmakers and industry leaders alike.

As the dialogue surrounding cryptocurrency regulation continues to evolve, the need for clarity and consistency from the SEC has never been more critical. Armstrong’s call to action underscores a profoundly important reality: without trust in regulatory institutions, the entire industry risks stagnation. Although an apology may not erase the missteps of the past, it could illuminate a path forward where collaboration and understanding pave the way for a more robust framework that supports innovation while ensuring adequate protection for investors. As this conversation unfolds, the future of crypto regulation hinges on the SEC’s ability to adapt and clarify its stance decisively.

Leave a Reply