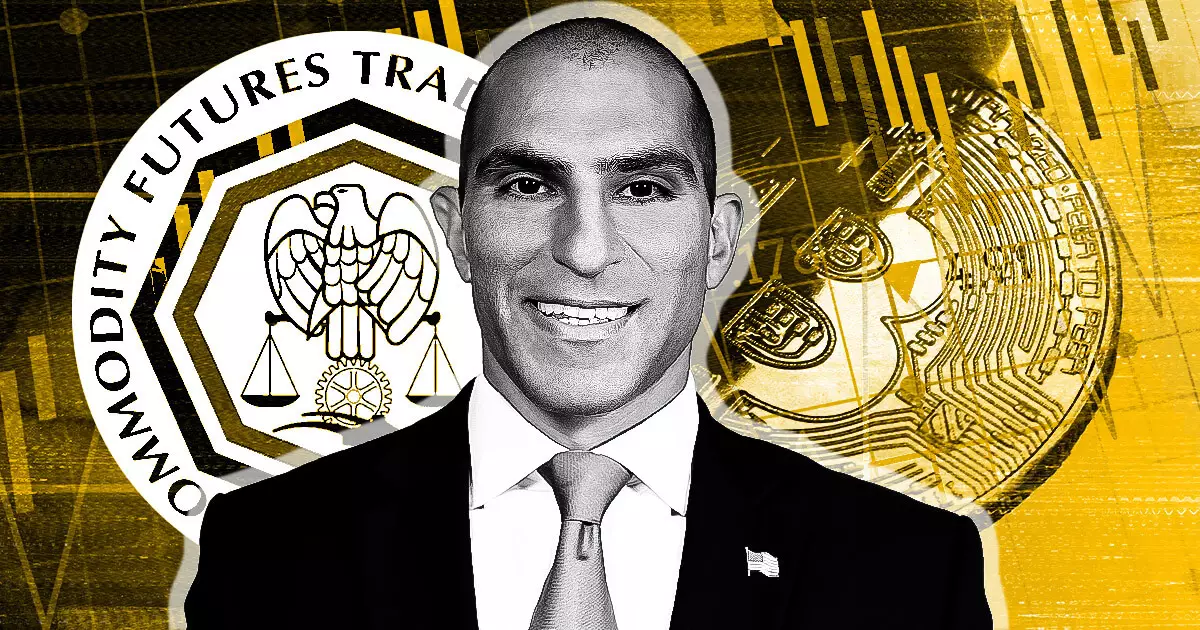

The recent Senate Agriculture Committee hearing on digital commodities oversight shed light on the Commodity Futures Trading Commission’s (CFTC) willingness to take on a more prominent role in regulating the crypto market. CFTC chair Rostin Behnam expressed openness to the idea of serving as the primary regulator for digital assets, signaling a potential shift in regulatory authority. This move could potentially streamline the oversight process, with the Securities and Exchange Commission (SEC) focusing on a smaller subset of assets.

Behnam acknowledged that for the CFTC to become the primary regulator for crypto, changes to the definitions of securities and commodities would be required. This highlights the complexities involved in expanding the CFTC’s jurisdiction and the need for regulatory clarity in the evolving digital asset landscape. Behnam’s recognition of the need for regulatory adaptations underscores the challenges inherent in overseeing a rapidly developing market.

While discussing the division of regulatory responsibilities between the CFTC and the SEC, Behnam emphasized the importance of cooperation between the two agencies. He rejected the idea of the SEC unilaterally determining which assets fall under the CFTC’s purview, emphasizing the need for collaboration in defining assets with ambiguous classifications. Behnam’s emphasis on the history of cooperation between the CFTC and the SEC highlights the significance of regulatory coordination in addressing regulatory gaps.

Addressing Legal Concerns

Concerns were raised during the hearing regarding potential lawsuits stemming from conflicting asset designations. Behnam acknowledged the possibility of legal challenges but stressed the benefits of cooperation between the CFTC and the SEC in resolving novel legal issues. By advocating for a systematic approach to listing contracts that aligns with existing regulatory frameworks, Behnam aimed to mitigate legal uncertainties and facilitate the introduction of tokens and contracts to regulated markets.

Behnam outlined the financial resources necessary for the CFTC to establish a regulatory framework for the crypto market. He estimated that the agency would need at least $30 million in the first year and $50 million in the second year to support staffing, administration, and IT infrastructure. Behnam proposed that user fees levied on registrants could offset the required funds, emphasizing the importance of adequate financial resources in implementing effective regulatory oversight.

The CFTC’s stance on regulating crypto reflects a proactive approach to addressing the challenges posed by the digital asset market. Behnam’s openness to assuming a primary regulatory role, coupled with his emphasis on collaboration, regulatory clarity, and financial sustainability, underscores the agency’s commitment to adapting to the changing landscape of digital commodities. By navigating the complexities of regulatory authority and highlighting the need for cooperation and adaptability, the CFTC is poised to play a pivotal role in shaping the future of the crypto market.

Leave a Reply