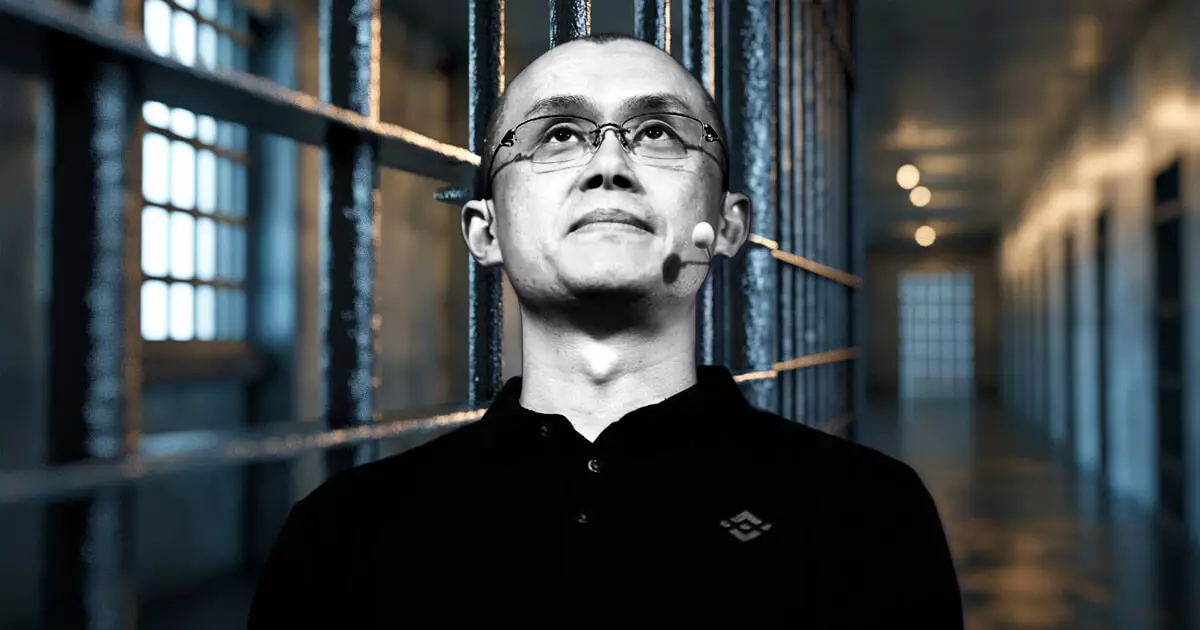

Changpeng Zhao, the prominent figure behind Binance, has found himself at the center of significant legal scrutiny that has culminated in a notable prison sentence. As of September 29, Zhao is set to be released from U.S. custody after serving a four-month sentence, a journey marred by allegations that stem back to late 2022. This article dissects the implications of Zhao’s legal troubles, the repercussions for Binance, and the broader regulatory landscape that surrounds cryptocurrency exchanges.

Recent reports indicate that Zhao has been transferred to the Long Beach Residential Reentry Management facility in California, a transitional hub for inmates preparing for reintegration into society. This phase of his sentence allows for a semblance of autonomy as he approaches release. Zhao’s sentencing is a result of serious charges which assert that both he and Binance engaged in unlawful practices, primarily concerning the anti-money laundering protocols mandated by the Bank Secrecy Act.

The crux of the allegations spotlight a systemic failure in Binance’s compliance measures, leading to accusations that the platform inadvertently facilitated transactions tied to illicit activities. This situation highlights a critical junction for the cryptocurrency space, where regulatory oversight is increasingly scrutinized. The substantial fines imposed—$4.3 billion on Binance and a personal $50 million by Zhao—underline the severity of these infractions.

While Zhao may be on the cusp of personal legal resolution, Binance’s future remains precarious. The U.S. Securities and Exchange Commission (SEC) has escalated its engagement with the exchange, recently amending its complaints against Binance. This move further complicates the already fraught operational landscape for one of the largest cryptocurrency exchanges globally.

The SEC’s stance indicates a belief that Binance’s operations could potentially violate various aspects of federal securities laws. Particularly, the regulator highlights Binance’s role in amplifying market information surrounding digital assets, questioning whether it has acted as an unregistered exchange. This situation is particularly alarming given the characterization of Binance’s native token, BNB, as a security—an assertion that could have profound implications for how cryptocurrencies are viewed and regulated in the U.S.

Zhao’s situation serves as a microcosm for the broader turmoil facing the cryptocurrency industry. Regulatory bodies are grappling with how to appropriately govern this burgeoning sector, wrestling with concerns over investor protection, market integrity, and the blurring lines between traditional and digital assets. The uncertainty laid bare by these developments may lead to more refined regulatory frameworks emerging in the U.S. and abroad.

While Zhao’s release marks an end to a particularly turbulent chapter in his life, it opens the door to further scrutiny for Binance and the entire cryptocurrency ecosystem. Observers will be keenly watching as the aftermath of Zhao’s legal battles unfolds and as regulatory authorities continue to shape the future of digital currency trading. This case may well set precedents for how digital assets are managed, traded, and regulated in the years to come.

Leave a Reply