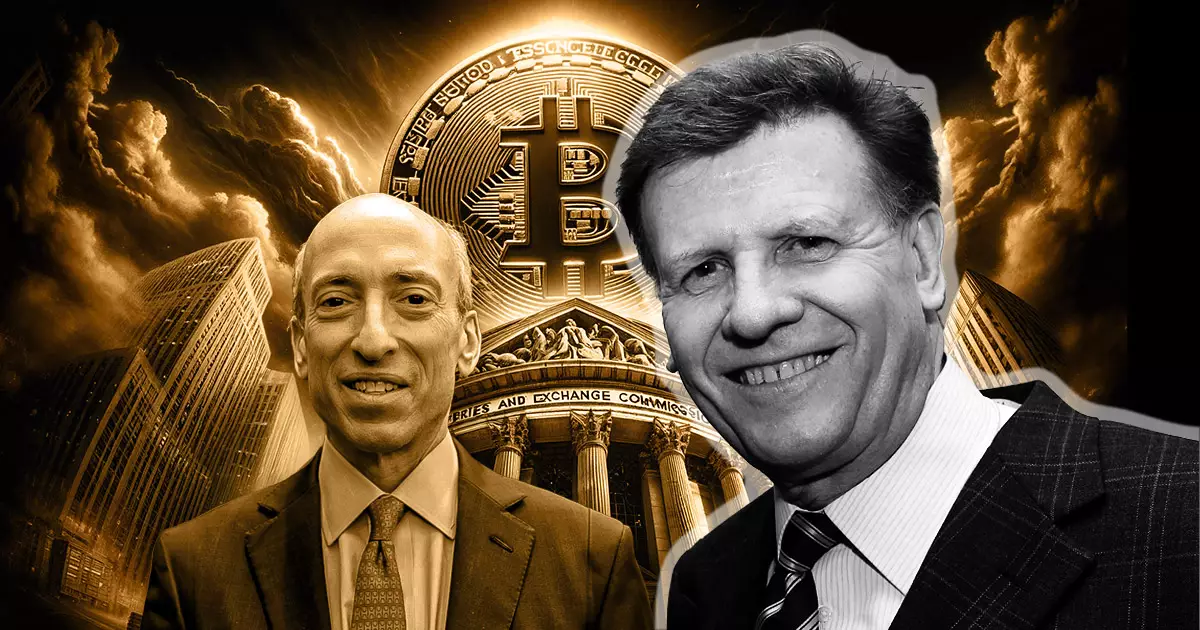

Bitcoin, the flagship cryptocurrency, continues to be a subject of debate among experts in the financial market. A recent interview on CNBC’s “Squawk Box” featuring Joe Kernen, a news anchor, and SEC Chair Gary Gensler shed light on differing perspectives about Bitcoin’s decentralized nature and its role in investor protection. In this article, we delve into the arguments presented by both individuals and explore the implications for the cryptocurrency market.

During the interview, Gary Gensler expressed skepticism about Bitcoin’s level of decentralization. According to him, the limited number of exchanges where Bitcoin can be traded undermines its decentralized nature. He further labeled spot Bitcoin ETFs as “ironic” due to their centralized nature. Gensler emphasized that only the accounting ledger underpinning the cryptocurrency could be deemed as truly decentralized. These assertions by the SEC Chair aroused a spirited response from Joe Kernen, who defended Bitcoin’s decentralized ledger as a core feature that contributes to its integrity and attractiveness to investors.

Joe Kernen passionately argued that Bitcoin’s decentralized ledger is stored in a ledger accessible to everyone, thereby reducing the risk of double-counting. He acknowledged its immutability as a factor that bolsters the perceived inherent value of the cryptocurrency. Kernen even questioned Gensler’s negative stance in light of his own previous involvement in teaching about Bitcoin at MIT. His argument highlighted the popularity and widespread adoption of Bitcoin among investors, suggesting that it should be recognized beyond being a speculative asset.

Gary Gensler emphasized that the SEC’s approval of Bitcoin ETFs should not be construed as an endorsement of the cryptocurrency itself, but rather as a means to enable regulated trading of Bitcoin within exchange-traded products. He stressed the importance of investor protection and adherence to securities laws, asserting that companies must provide comprehensive and truthful disclosures to the public. Kernen, however, questioned the perceived neutrality of the SEC’s stance, suggesting a hesitancy towards embracing Bitcoin.

Both parties acknowledged the existence of concerns relating to fraud and manipulation within the cryptocurrency space. Gensler highlighted the risks associated with crypto investments and stressed the need for robust regulatory frameworks to safeguard investors. On the other hand, Kernen pointed out that illicit financial flows involving cryptocurrencies represent only a small fraction compared to those involving the US dollar. He countered Gensler’s argument by suggesting that Bitcoin was not the primary “token of choice” for ransomware.

The debate surrounding Bitcoin’s decentralization and investor protection continues to be a topic of interest among industry insiders. While Gary Gensler’s skepticism raises valid concerns about the centralized aspects of the cryptocurrency, Joe Kernen passionately defends the decentralized ledger as a critical feature that enhances Bitcoin’s integrity and perceived value. As the cryptocurrency market evolves, striking a balance between regulatory oversight and the inherent principles of decentralization will remain a challenge. Nonetheless, ongoing discussions and debates pave the way for a better understanding of Bitcoin and its role in the future of finance.

Leave a Reply