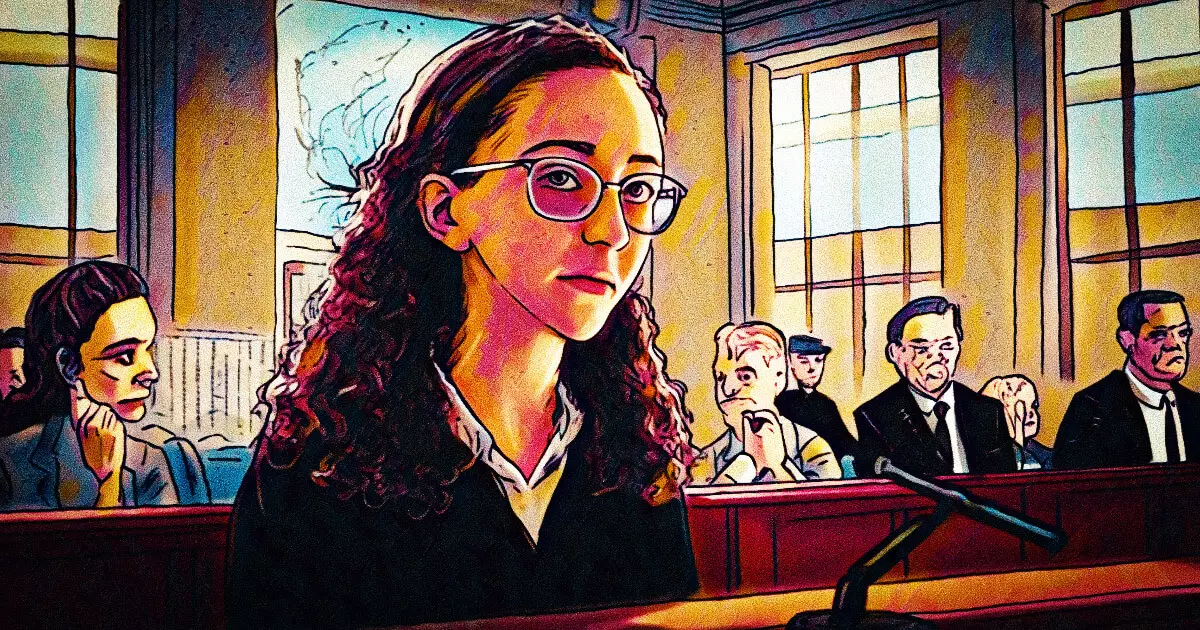

The recent sentencing of Caroline Ellison, the former CEO of Alameda Research, marks a pivotal moment in the ongoing saga surrounding the collapse of FTX. Sentenced to two years in prison and ordered to forfeit an astonishing $11 billion, Ellison’s case not only embodies individual accountability but also raises vital questions about ethical practices in the cryptocurrency sector.

Ellison’s involvement in the FTX debacle cannot be understated. As one of the key figures behind Alameda Research, her decisions directly influenced the fate of the once-thriving cryptocurrency exchange. Despite her arguments for leniency, hinging on her cooperation with federal authorities to convict Sam Bankman-Fried (SBF), the court ultimately imposed a significant penalty. Ellison’s two-year prison sentence seems to serve as a stark reminder that the legal system is set to hold even high-ranking employees accountable for their roles in corporate negligence and fraud.

Whether her cooperation truly warranted a lighter sentence is debatable. Her plea deal seemed to position her as a crucial witness against SBF, who now faces 25 years behind bars. This plea not only highlights the intricate web of deceit and poor governance within the crypto landscape but also raises ethical dilemmas regarding the morality of cooperation in criminal cases. Market manipulation and unethical practices are rife within the cryptocurrency realm, and Ellison’s sentencing serves as a potent warning to other executives in the industry.

The narrative surrounding Ellison’s relationship with SBF adds a compelling layer to the story. Her legal team emphasized that her moral compass was skewed by her personal and professional relationship with SBF. This plea underscores a growing concern about corporate culture, particularly in high-stakes environments like cryptocurrency. The blurred lines between personal loyalty, ethical judgment, and professional responsibility can lead to catastrophic decisions. It raises significant questions about how organizations can foster ethical decision-making and accountability among their teams.

Moreover, the testimonies presented by Ellison’s legal team painted a picture of a once-commended but now fallen leader whose narratives highlight the pitfalls of a rapidly evolving sector. The legal implications of her case go beyond individual guilt; they underscore the need for systemic reform within the cryptocurrency industry.

A Broader Context of Consequences

As important as Ellison’s case is, it is a part of a larger framework concerning the accountability of crypto executives. Other figures in the FTX scandal, such as Ryan Salame, who received a sentence of seven and a half years, as well as those still awaiting sentencing, underscore a movement toward stricter scrutiny of corporate behaviors in the financial technology space. The consequences for these executives serve as a stark reminder that the once-permissive crypto realm is increasingly coming under the regulatory microscope.

Caroline Ellison’s sentencing encapsulates the intertwining of personal failings, corporate responsibility, and the urgent need for accountability in a sector notorious for its rapid developments and moral ambiguities. As the cryptocurrency industry continues to mature, it becomes imperative to root out unethical practices and to ensure that individual actions, no matter how high-ranking, are met with appropriate consequences.

Leave a Reply