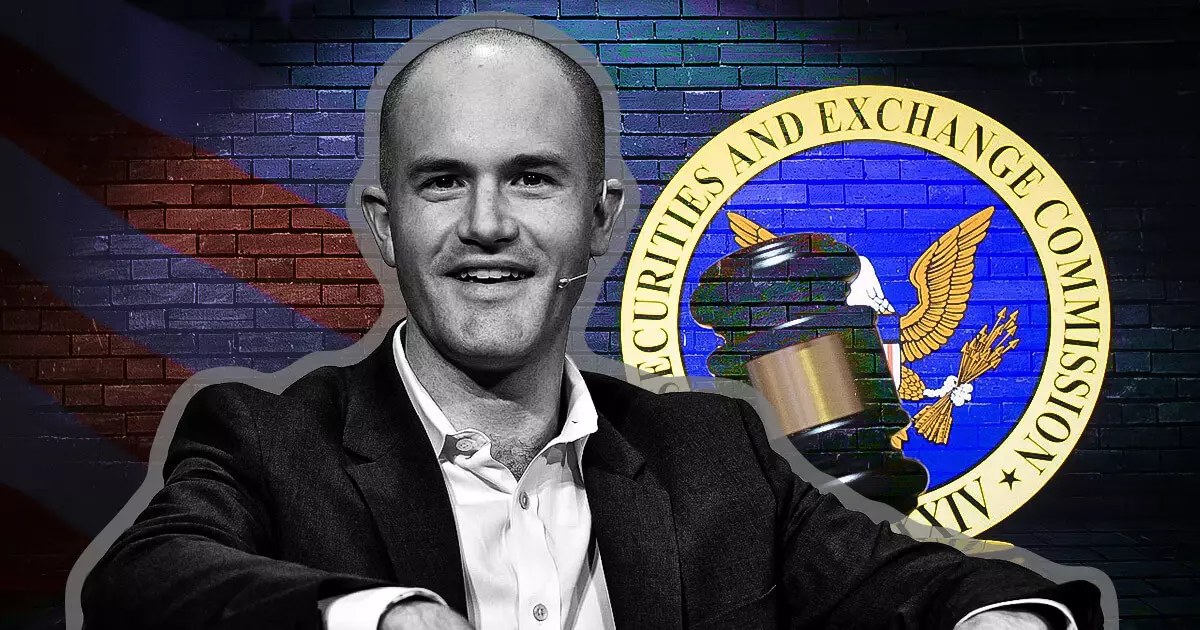

In a pivotal move reflecting the growing friction between cryptocurrency platforms and regulatory bodies, Coinbase’s CEO Brian Armstrong announced a significant shift in the exchange’s approach to legal partnerships. By declaring that Coinbase would no longer work with law firms that enlist former regulatory officials associated with what he called “unlawful” actions against the crypto sector, Armstrong sets the stage for a new narrative within the crypto landscape. This announcement, made through a social media post on December 3rd, comes on the heels of Gurbir S. Grewal’s recent appointment to Milbank’s Litigation & Arbitration Group, a transition that did not go unnoticed by Armstrong.

Coinbase’s decision underscores a broader conflict as the industry navigates a complex regulatory environment, marked by what Armstrong deems a lack of clarity from the previous SEC administration under Gary Gensler. By taking a principled stand, Coinbase aims not only to protect its interests but also to foster a regulatory atmosphere that encourages innovation rather than stifles it.

In his statements, Armstrong did not shy away from being critical of the legal community, particularly the senior partners of the firms involved. He asserted that they remain “unaware” of the unique challenges facing the crypto industry, signaling a rift between traditional finance law and the burgeoning world of digital assets. More pointedly, Armstrong accused Grewal of perpetuating policies that he sees as ethical failures during his tenure at the SEC. This rhetoric illustrates a growing frustration within the cryptocurrency sector over perceived regulatory overreach and a lack of coherent guidance.

Furthermore, Armstrong’s comments highlight a trend where significant figures in the regulatory space transition into private practice, serving as legal advisors to industries they previously oversaw. This movement raises questions about conflicts of interest and the implications for both the regulating bodies and the industries affected by their decisions.

Armstrong’s call for the crypto community to reconsider their legal affiliations reflects a desire for greater accountability among legal practitioners and a commitment to protecting the integrity of the sector. His remarks suggesting that the hiring of individuals linked to prior regulatory injustices should result in the loss of clients illustrates a shift in how the industry may confront these challenges moving forward.

By establishing firm boundaries regarding partnerships, Coinbase is not only reasserting its brand but is also attempting to galvanize the broader cryptocurrency ecosystem into a unified front against regulatory practices they perceive as unjust. This defiance could potentially foster a climate of greater transparency and proactive engagement with regulators, which is crucial as the industry continues to evolve.

As the confrontation between the crypto industry and regulatory authorities escalates, Coinbase’s recent stance may serve as a pivotal moment for the sector. The call for clarity and more favorable conditions for innovation resonates with many stakeholders who feel that existing guidelines are inadequate. Armstrong’s emphasis on communication with legal firms might inspire other companies to take similar stands, potentially reshaping the dynamics between regulators and the cryptocurrency sector.

As Coinbase navigates this complex landscape, the consequences of these actions will be closely analyzed. The move signals not just a rejection of past affiliations but also a commitment to forging a future where regulatory practices align more closely with the innovative spirit of the digital currency realm. The coming months will be crucial for determining whether this strategy will foster a more collaborative environment with regulatory bodies or further complicate an already contentious relationship.

Leave a Reply