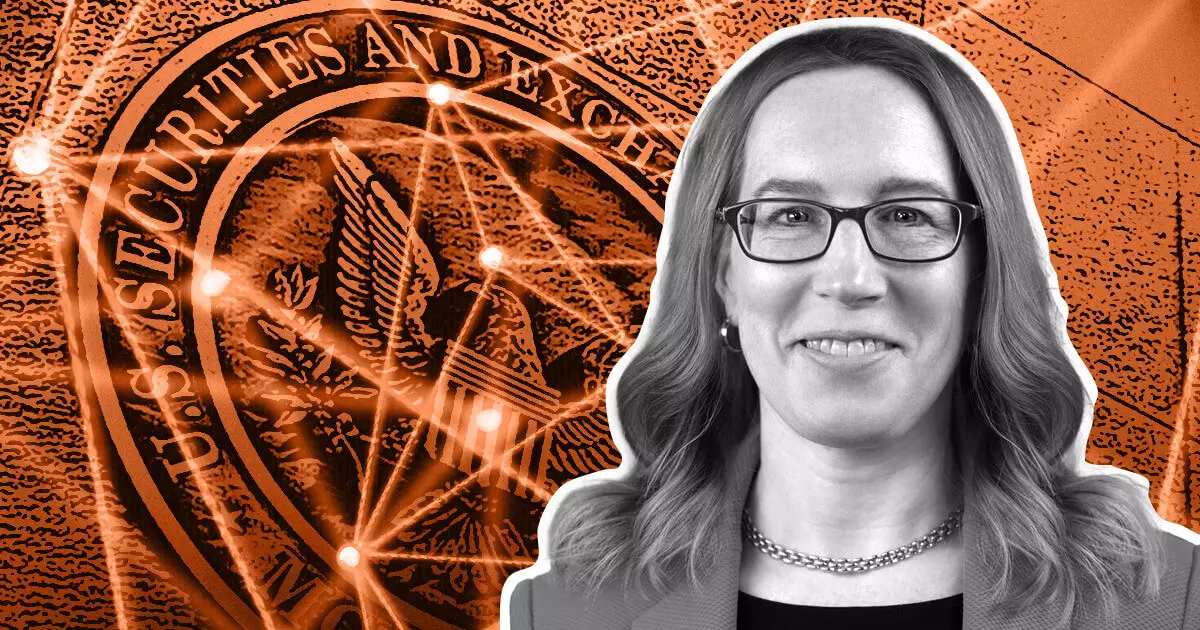

In a recent development, SEC commissioner Hester Peirce put forth an intriguing proposal for a shared digital securities sandbox between the US and the UK. This proposition aims to expand upon the existing joint digital securities sandbox (DSS) between the Bank of England and the FCA.

The primary objective of this proposed shared digital sandbox is to provide a platform where US and UK firms can engage in sandbox activities under similar regulatory conditions. By fostering collaboration between the two countries, participants will have the opportunity to test the viability of their products in both markets. This joint effort also entails an information-sharing agreement between the US and the UK, ensuring transparency and alignment in regulatory practices.

Under this proposed sandbox initiative, participating firms will have the autonomy to operate under self-selected regulatory conditions. This freedom allows firms to tailor their activities based on their specific needs and objectives, ultimately helping them build a strong market case for their products. Additionally, the sandbox serves as a platform for identifying and addressing potential design and implementation flaws while catering to real customer requirements.

A crucial aspect of this sandbox initiative is its focus on evaluating the use of distributed ledger technology (DLT) in facilitating securities issuance, trading, and settlement. By testing the capabilities of DLT without fear of regulatory repercussions, firms can explore innovative solutions for enhancing operational efficiency and transparency in the securities market.

The SEC’s role in this proposed sandbox involves permitting eligible firms to participate while ensuring adherence to specified regulatory conditions. Participants must submit notices of participation and maintain transparency regarding their involvement in the sandbox. The SEC’s FinHub will provide support in facilitating participation notices, offering guidance on regulatory compliance, and issuing necessary exemptions.

Commissioner Peirce’s proposal acknowledges potential concerns regarding firms selecting their regulatory conditions. However, she emphasizes that firms must adhere to reasonable conditions to maintain regulatory integrity. By outlining the benefits of such sandbox initiatives based on past experiences in the UK, Peirce aims to garner support for this collaborative approach.

The proposed digital securities sandbox is expected to generate several public benefits, including increased access to innovative products for consumers. By enabling firms to expedite market entry, the program could foster competition, drive innovation, and enhance the overall quality of services available to consumers.

The shared digital securities sandbox proposal put forth by SEC commissioner Hester Peirce represents a significant step towards fostering regulatory collaboration between the US and the UK. By creating a platform for firms to test and refine their products under similar regulatory conditions, this initiative has the potential to drive innovation, enhance market efficiency, and benefit consumers. While further developments are needed to finalize the details of this proposal, it underscores the importance of regulatory cooperation in facilitating industry growth and technological advancement.

Leave a Reply