The reign of Bitcoin as the leading NFT platform came to an abrupt end this month as Ethereum reclaimed its position at the top. Data from NFT analytics platform CryptoSlam paints a bleak picture for Bitcoin, with NFT sales on its network plummeting over 60% compared to the record highs of December. Ethereum, on the other hand, has maintained a steadier pace, solidifying its status as the go-to platform for NFT sales.

One of the main reasons for Bitcoin’s decline can be attributed to the fading hype surrounding Ordinals, a technology that enables inscriptions and non-fungible tokens directly on the Bitcoin blockchain. In December, the surge in Bitcoin NFT activity was largely driven by the excitement surrounding Ordinals, resulting in high fees for inscription minting. However, as interest in Ordinals waned, so did the demand for Bitcoin NFTs.

Minting fees for Ordinals have plummeted by 83% since their peak on January 14th, reflecting the diminishing appetite for these types of NFTs. Conversely, Ethereum’s established ecosystem and diverse functionalities have allowed it to maintain user interest and NFT trading volume throughout December and January.

The versatility and stability of the Ethereum network have positioned it as a frontrunner in the NFT space. Unlike Bitcoin, which has a nascent Ordinals scene, Ethereum boasts a wide range of projects and applications in its NFT landscape. This, coupled with its established infrastructure, has given Ethereum an edge over Bitcoin in terms of user interest and trading volume.

The rapid shift in the NFT market highlights the importance of adaptability and innovation within the industry. While Ordinals brought a unique use case to Bitcoin, its technical limitations and niche appeal have hindered its long-term sustainability. On the other hand, Ethereum’s flexibility and established infrastructure allow it to adapt to evolving market trends and user preferences.

It’s worth noting that the decline in interest for NFTs is not exclusive to Bitcoin. The overall decline in digital asset class interest has had an impact on both Bitcoin and Ethereum NFTs. However, Ethereum’s larger and more diverse user base, along with its well-established NFT ecosystem, suggest that it may be better equipped to weather the current market downturn.

As the NFT market continues to evolve, it is clear that the landscape is constantly shifting. Players in the industry must be able to adapt and stay ahead of the curve to succeed. The future of the NFT market remains uncertain, and while Bitcoin may have lost its leading position for now, it’s important to remember that the market can change again. Only time will tell which platform will ultimately dominate the NFT space.

It’s important to note that this article is for educational purposes only. The opinions expressed here do not represent the views of NewsBTC on whether to buy, sell, or hold any investments. As with any investment, there are risks involved, and it is advisable to conduct your own research before making any decisions. Use the information provided here at your own risk.

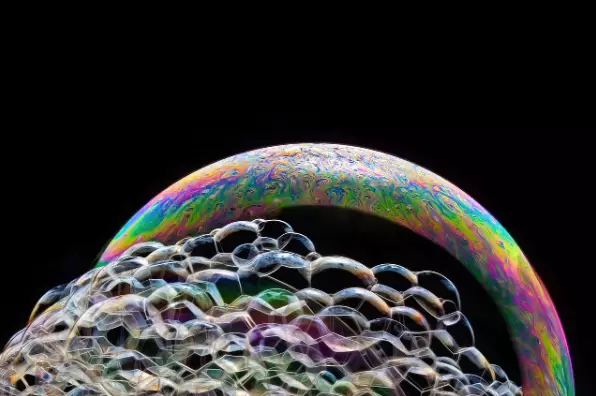

(featured image from Pixabay, chart from TradingView)

Leave a Reply