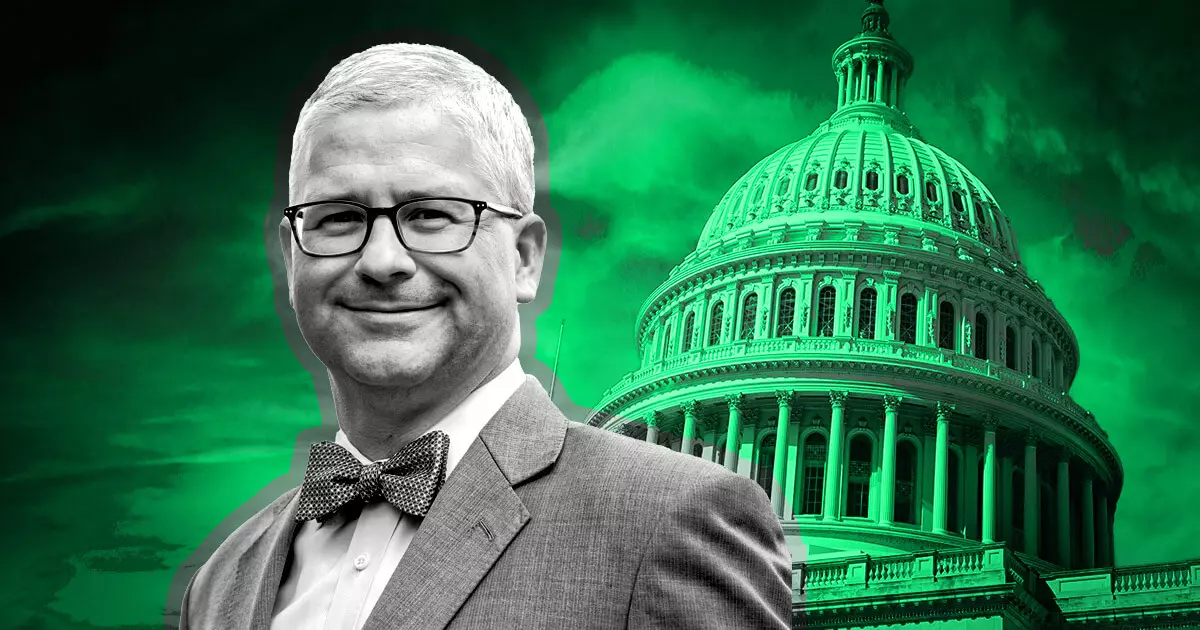

House Financial Services Committee Chairman Patrick McHenry has announced that new legislation, known as the Financial Innovation and Technology for the 21st Century (FIT21) Act, is on track for a potential House floor vote by the end of May. This legislation aims to address the regulatory uncertainties surrounding the digital asset market, providing clear frameworks for oversight and consumer protection.

McHenry emphasized the importance of this legislation in fostering innovation and protecting consumers within the U.S. digital asset ecosystem. The lack of regulatory clarity has hindered progress and left both industry participants and consumers vulnerable to potential risks. By establishing clear guidelines, the FIT21 Act seeks to create a more stable and secure environment for digital asset development and investment.

Crypto Council CEO Sheila Warren has confirmed that the House Committee on Rules will be reviewing the legislation during the week of May 20. The composition of the committee, consisting of nine Republicans and four Democrats, will play a significant role in determining the fate of FIT21. The use of a “structured rule” will guide the consideration process, dictating which amendments can be proposed and the duration of debates on both sides.

One of the key aspects of the FIT21 Act is the allocation of regulatory responsibilities between the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). The legislation specifies that the CFTC will oversee crypto commodities, while the SEC will regulate crypto assets offered through investment contracts. This delineation aims to provide clarity for market participants and streamline the regulatory process.

With the SEC’s enforcement actions in the crypto space generating significant attention, the FIT21 Act could help address some of the controversies surrounding regulatory oversight. The legislation outlines rules for companies required to register with both the SEC and CFTC, including provisions for customer disclosure, asset protection, and operational standards. By promoting compliance and transparency, FIT21 aims to elevate industry standards and safeguard investor interests.

The Financial Innovation and Technology for the 21st Century (FIT21) Act represents a crucial step towards clarifying regulatory oversight in the crypto industry. By establishing clear guidelines and delineating regulatory responsibilities, the legislation aims to foster innovation, protect consumers, and enhance market integrity. The upcoming House floor vote on FIT21 holds the potential to reshape the landscape of the digital asset market, paving the way for a more robust and sustainable ecosystem.

Leave a Reply