Christopher Giancarlo, once at the helm of the Commodity Futures Trading Commission (CFTC), has recently refuted speculations suggesting he might take on the role of Chair at the U.S. Securities and Exchange Commission (SEC). Interestingly, he has also expressed disinterest in potential crypto-related positions within the U.S. Treasury Department. Giancarlo’s statement, particularly his reference to having tidied up what he deemed “the mess” left by his predecessor Gary Gensler at the CFTC, raises questions about the current regulatory environment. His comments hint at a broader, ongoing tension in the cryptocurrency landscape marked by enforcement strategies that many believe may not be conducive to the industry’s growth.

Giancarlo’s remarks bring to light what he describes as a troubling approach taken by the SEC—often characterized as “regulation by enforcement.” This has drawn sharp criticism from various factions within the cryptocurrency space. Some industry players perceive the SEC’s methods as detrimental, lacking the clarity necessary for innovation to flourish. The insinuation that Gensler may have left a mess suggests a strong sentiment that many see the SEC’s hardline tactics as reactionary rather than progressive. With no shortage of digital assets, the possibility of overregulation looms large, igniting fear of stifling a nascent yet innovative sector.

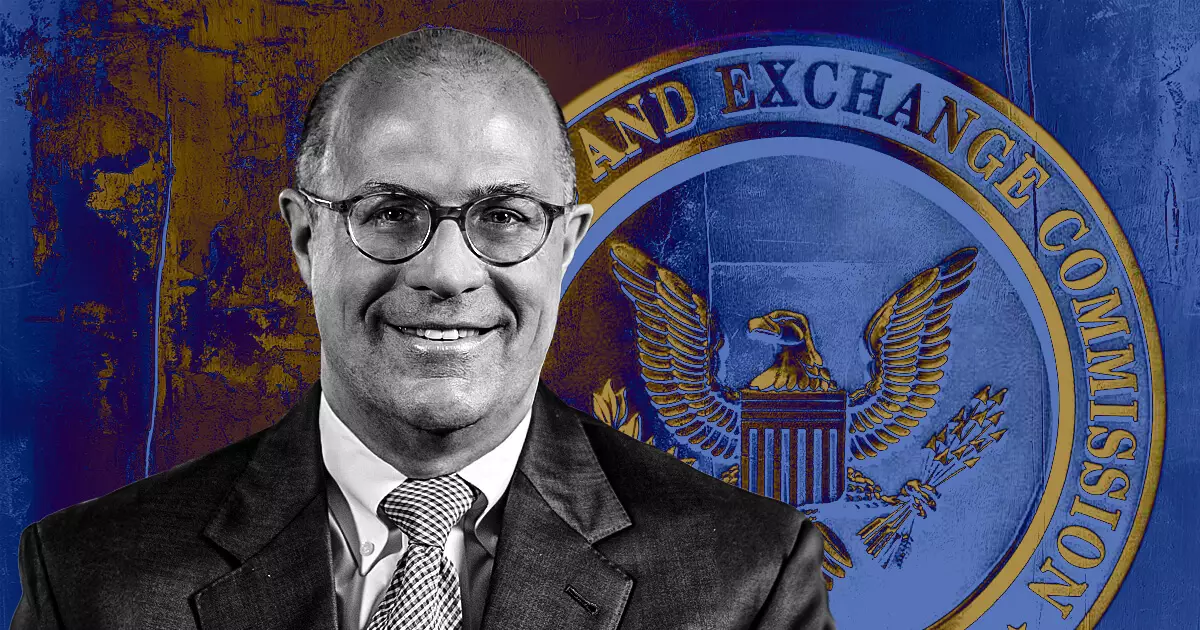

Dubbed ‘Crypto Dad’ by advocates for cryptocurrency, Giancarlo has been a vocal supporter of the digital currency movement from as early as 2018, famously asserting that “cryptocurrencies are here to stay.” His tenure at the CFTC saw a more accommodating stance towards digital assets, which could differ sharply from Gensler’s current regulatory posture. Giancarlo’s recent autobiography underscores his commitment to balancing regulatory oversight while fostering innovation in the cryptocurrency realm. Interestingly, he’s now serving as an advisor for the U.S. Digital Chamber of Commerce, signaling his ongoing commitment to helping shape a favorable regulatory framework for cryptocurrencies.

Since Gensler took the helm in 2021, the SEC has ramped up its legal actions against a multitude of crypto firms, enforcing its regulations with increased vigor. Although Gensler maintains that many digital assets likely fall under the classification of securities, this assertion brings forth fundamental debates about compliance and investor protection. He argues that this classification remains necessary to mitigate potential investor losses, especially in light of instances of regulatory lapses leading to catastrophic failures in some projects. Nevertheless, critics argue that the lack of comprehensive regulatory clarity constrains the sector and hampers innovation.

As the cryptocurrency market teeters on the precipice of regulatory overhaul, the conversation between Giancarlo and Gensler represents two divergent philosophies: one advocating for cautious regulation, and the other promoting strict enforcement. The future of cryptocurrency regulation in the United States lies in finding a delicate balance between protective measures for investors and unleashing the full potential of innovation within this transformative landscape. As stakeholders await more definitive guidance, the pressing challenge remains to foster an environment ripe for growth while safeguarding the interests of consumers. Whether through clearer regulations or more cooperative engagement with industry players, the pathway forward will require astute deliberation and strategic vision.

Leave a Reply