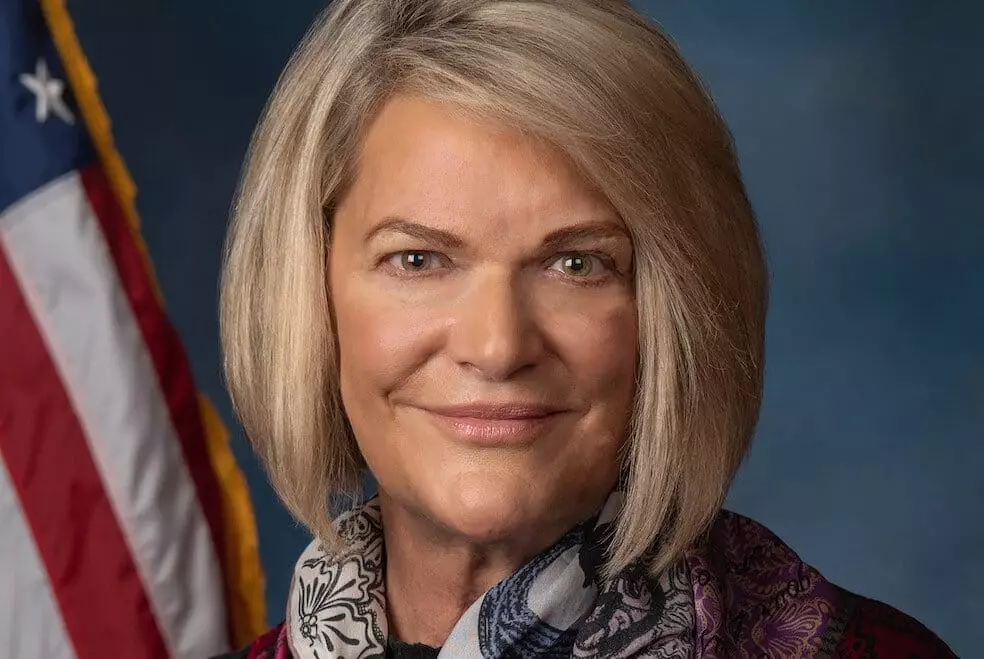

In a recent report on March 7, U.S. Senators Cynthia Lummis and Kirsten Gillibrand are getting ready to announce a stablecoin regulation bill. The bill has received positive feedback from key stakeholders, including the Treasury and the New York Department of Financial Services. Senator Lummis, known for her pro-Bitcoin stance, has emphasized the need for deeper integration of digital assets into the government’s operations. However, the Senator has expressed concerns about stablecoins like Tether and even called for the Department of Justice to consider filing criminal charges against Tether and Binance for alleged connections to illicit financing.

Senator Lummis has also taken a firm stance against central bank digital currencies (CBDCs), denouncing them as “anti-democratic” and “a means of financial censorship.” She has been vocal about the Fed’s inability to introduce a CBDC without congressional approval, highlighting her opposition to state-controlled digital assets.

Federal Reserve’s Position on CBDCs

Jerome Powell, the chair of the Federal Reserve, has refrained from commenting on the potential adoption of a CBDC in the US, stating that the country is not close to creating one. Stablecoins, valued at around $150 billion, have been viewed as potential threats to anti-money laundering and counter-terrorism regulations in America.

Legislation Clarity on Stablecoins

The proposed legislation by Senators Lummis and Gillibrand aims to provide regulatory clarity around stablecoins while protecting consumers from malicious actors. The bill is anticipated to have a higher chance of passing Congress, with ongoing discussions with the House Financial Services Committee to ensure a balance between federal and state authorities.

While the US deliberates on stablecoin regulations and CBDC launch, other countries, such as the UK, have made progress in allowing CBDCs and stablecoins to coexist. In the UK, regulators like the HM Treasury, the Financial Conduct Authority, and the Bank of England are exploring the possibility of a digital pound or Britcoin.

Various countries across the globe have initiated pilot CBDC programs, such as China’s e-yuan and the Philippines’ wholesale CBDC pilot program. Hong Kong is also making strides in the development of wholesale CBDCs. Despite the advancements in other countries, the US is lagging in its decision-making process regarding stablecoin regulations and CBDC implementation.

Overall, the proposed stablecoin regulation bill by Senators Lummis and Gillibrand sheds light on the complexities surrounding digital assets and government involvement in the cryptocurrency space. As the world moves towards a more digital economy, regulatory frameworks will play a crucial role in shaping the future of decentralized finance. It remains to be seen how the US will navigate the challenges and opportunities presented by cryptocurrencies in the coming years.

Leave a Reply