Recent on-chain data has revealed alarming activity from a dormant Bitcoin wallet that transferred over $6.8 million worth of Bitcoin after 12 years of inactivity. The sudden movement of funds, with a total of 119 BTC, has sparked concerns within the crypto community about a potential sell-off by a significant whale. The two separate transactions sent the funds to an unknown address (3Ctd5), raising questions about the intentions behind the move.

The timing of this large transfer is particularly worrisome as Bitcoin is already facing significant selling pressure in the market. If the whale behind the dormant wallet decides to offload their holdings, it could further exacerbate the downward trend in Bitcoin’s price. However, the fact that the 119 BTC remains intact in the unknown address offers a glimmer of hope for investors who fear a massive sell-off.

Aside from the dormant wallet activity, other entities are also contributing to the selling pressure in the Bitcoin market. Notably, the German government has been actively selling off large amounts of Bitcoin, totaling up to $175 million. These transactions, which include transfers to major exchanges like Kraken, Bitstamp, and Coinbase, indicate a significant amount of selling activity from institutional players.

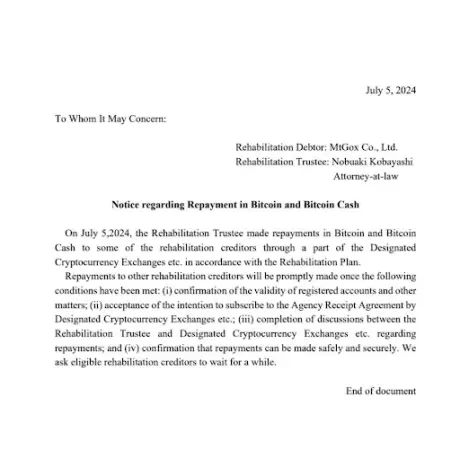

On a separate note, the defunct crypto exchange Mt. Gox has announced the start of repayments to its creditors, further adding to the selling pressure on Bitcoin. The rehabilitation trustee for Mt. Gox has already initiated Bitcoin repayments to some creditors through designated crypto exchanges. This development is likely to lead to more selling activity from creditors who opt to liquidate their holdings upon receiving their repayment.

Overall, the recent activity in the Bitcoin market, including the large transfer from the dormant wallet, the selling pressure from the German government, and the creditor repayments from Mt. Gox, all point to a challenging time for the flagship cryptocurrency. Investors and traders are advised to closely monitor these developments and adjust their strategies accordingly to navigate the volatile market conditions effectively.

Leave a Reply