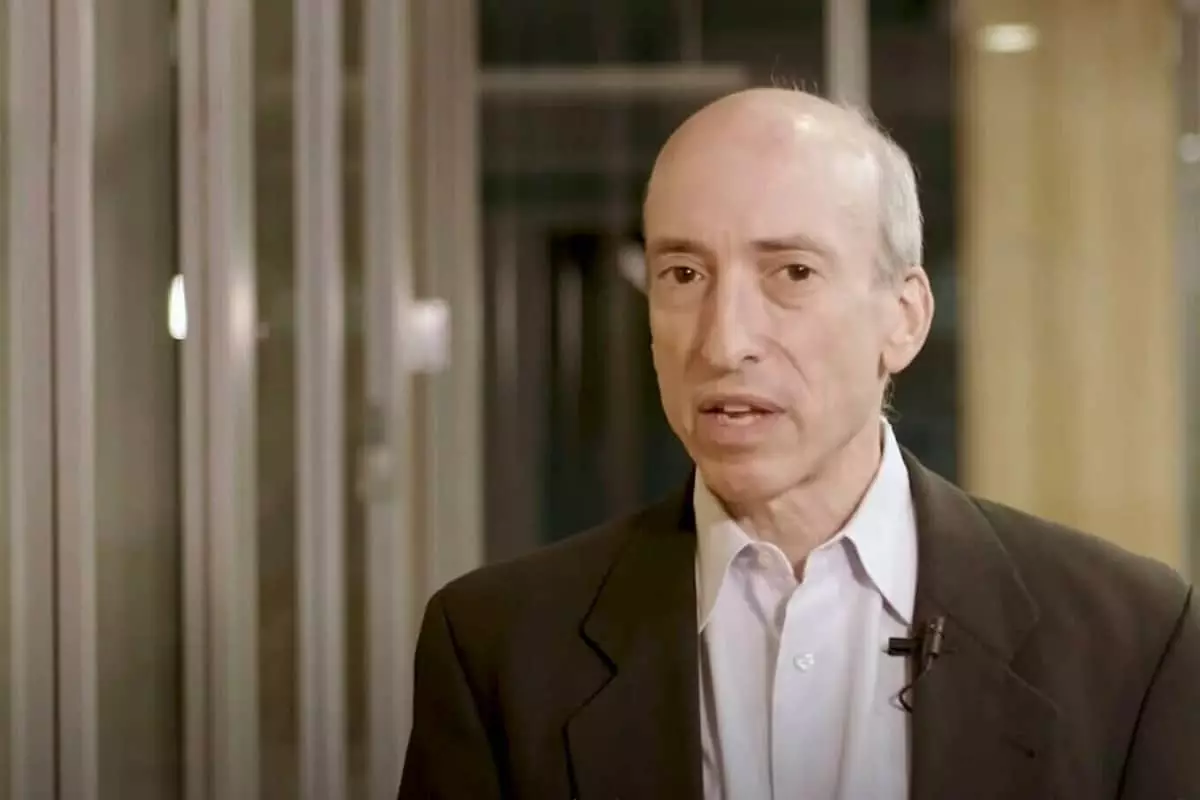

The Chairman of the United States Securities and Exchange Commission (SEC), Gary Gensler, has issued a warning to investors considering investing in crypto assets ahead of potential spot Bitcoin ETF approvals. In a series of tweets on January 8, 2024, Gensler emphasized the risks and volatility associated with cryptocurrencies and highlighted concerns about compliance with federal securities laws.

Gensler’s cautionary message emphasized the exceptional risk and volatility associated with cryptocurrencies. He urged investors to consider that asset managers offering crypto investment vehicles may not be complying with federal securities laws. This raises concerns about the lack of key information and important investor protections when investing in crypto asset securities.

Gensler pointed out instances of major platforms and crypto assets becoming insolvent or losing value, further emphasizing the ongoing significant risks of crypto investments. He highlighted the prevalence of fraud in the crypto space, where fraudsters exploit the growing popularity of crypto assets to deceive retail investors through scams such as bogus coin offerings, Ponzi and pyramid schemes, and outright theft. Gensler warned investors to remain vigilant to avoid falling victim to fraudulent activities.

While Gensler’s comments did not provide explicit hints about the SEC’s stance on spot Bitcoin ETFs, some observers view his statements as a final statement before the agency makes decisions on ETF applications approaching key deadlines. Approval of fully regulated spot ETFs could facilitate easier trading of digital assets for a broader range of investors, potentially leading to significant inflows into the crypto industry.

The SEC, under Gensler’s leadership, has been actively addressing the compliance of cryptocurrency businesses with securities laws. The regulatory approach has faced legal battles with mixed outcomes, but also notable victories. For example, a recent ruling in the Terraform Labs case affirmed the SEC’s stance on the improper promotion of unregistered crypto securities by the company.

The expectation of a Spot Bitcoin ETF receiving its first approval in the United States has grown, with Bloomberg recently upgrading its projection to a 95% chance of approval. However, the decision remains uncertain, especially considering the January 10 deadline for the SEC to respond to the first application in the recent wave submitted by ARK Investment and 21Shares.

Several well-known firms, including Valkyrie, WisdomTree, BlackRock, VanEck, Invesco, Galaxy, Grayscale, Fidelity, Bitwise, and Franklin Templeton, have also submitted their applications for spot Bitcoin ETFs. It remains unclear whether these applications will be approved simultaneously or individually.

The SEC holds broad authority in the decision-making process and could potentially consider delaying a decision again, leading to criticism directed at Chairman Gensler for the delay in approving a spot crypto ETF despite the multiple applications from asset managers spanning several years.

Gensler’s recent comments align with his past warnings to crypto investors and emphasize the SEC’s time-tested review process. In August, a federal judge instructed the SEC to reevaluate a spot BTC ETF application from Grayscale, stating that the commission’s denial was “arbitrary and capricious.”

As the SEC continues its review process for spot Bitcoin ETFs, it retains the option to deny applications, although any denials would likely require different reasons than those previously cited for denying other ETFs. The regulatory landscape for crypto assets remains dynamic, and investors must carefully consider the risks and uncertainties associated with these investments.

Gary Gensler, the Chairman of the SEC, has issued a warning for potential investors considering investing in crypto assets, particularly with the anticipation of spot Bitcoin ETF approvals. The risks and volatility associated with cryptocurrencies, along with concerns about compliance with securities laws and the prevalence of fraud in the crypto space, should be carefully considered by investors. The SEC’s decision on spot Bitcoin ETF applications remains uncertain, but it is an area of ongoing focus for the regulatory body. Ultimately, investors should exercise caution and conduct thorough due diligence before making any investment decisions in the crypto industry.

Leave a Reply